Project Summary

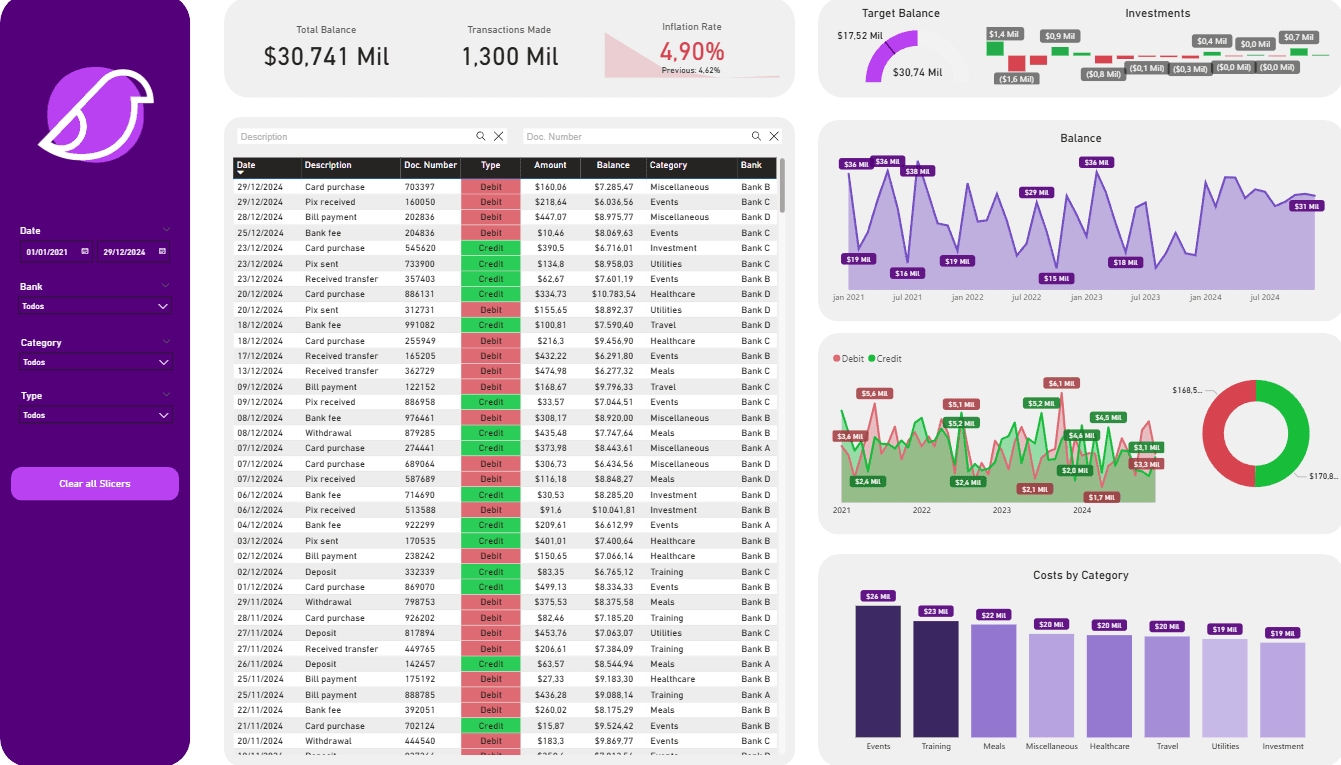

This project is a complete dashboard for personal finance control and analysis, developed in Microsoft Power BI. The solution centralizes transactions from multiple bank accounts into a single interface, providing the user with a holistic view of their financial health, with analyses of cash flow, net worth evolution, expenses by category, and goal tracking.

Objectives

Centralize Information: Consolidate data from different sources (banks) for a unified financial analysis.

Monitor Cash Flow: Track inflows (credits) and outflows (debits) in detail to understand monthly movements.

Analyze Spending Patterns: Identify the main expense categories, assisting in budget creation and spending optimization.

Track Goals and Investments: Visualize progress toward financial goals (like a target balance) and monitor investment performance.

Tools and Technologies

Platform: Microsoft Power BI

Analysis Language: DAX (Data Analysis Expressions) for calculating financial KPIs, such as cumulative balance, totals by category, and performance metrics.

Data Source: Analysis based on bank statements and financial transaction spreadsheets, which were processed and modeled for the analysis.

Key Features and Analyses

The dashboard was designed to offer a 360º view of the user's finances through several analytical components:

Control Panel (Main KPIs): The top of the dashboard displays the most important indicators clearly and immediately:

Total Balance: The consolidated net worth.

Transactions Made: The total volume of movements in the period.

Inflation Rate: A macroeconomic data point to contextualize purchasing power.

Target Balance: A goal-tracking KPI that compares the current balance against a predefined target.

Investments: Cards that summarize the values allocated in different types of investments.

Cash Flow Analysis (Debit vs. Credit): An overlapping area chart allows for a direct visual comparison between revenue and expenses over time, making it easy to identify months with a surplus or deficit.

Net Worth Evolution: The "Balance" area chart shows the trajectory of the total balance month by month, allowing for a clear visualization of net worth growth (or decline).

Expense Analysis by Category: A bar chart details where the money is going, classifying costs into categories like "Events," "Housing," "Healthcare," and "Travel," which is essential for any budget planning.

Detailed Transaction Log: An interactive table displays all transactions, allowing for searches, filters, and the verification of specific entries, ensuring full transparency and control.

Dashboard